Federal Work Opportunity Tax Credit (WOTC)

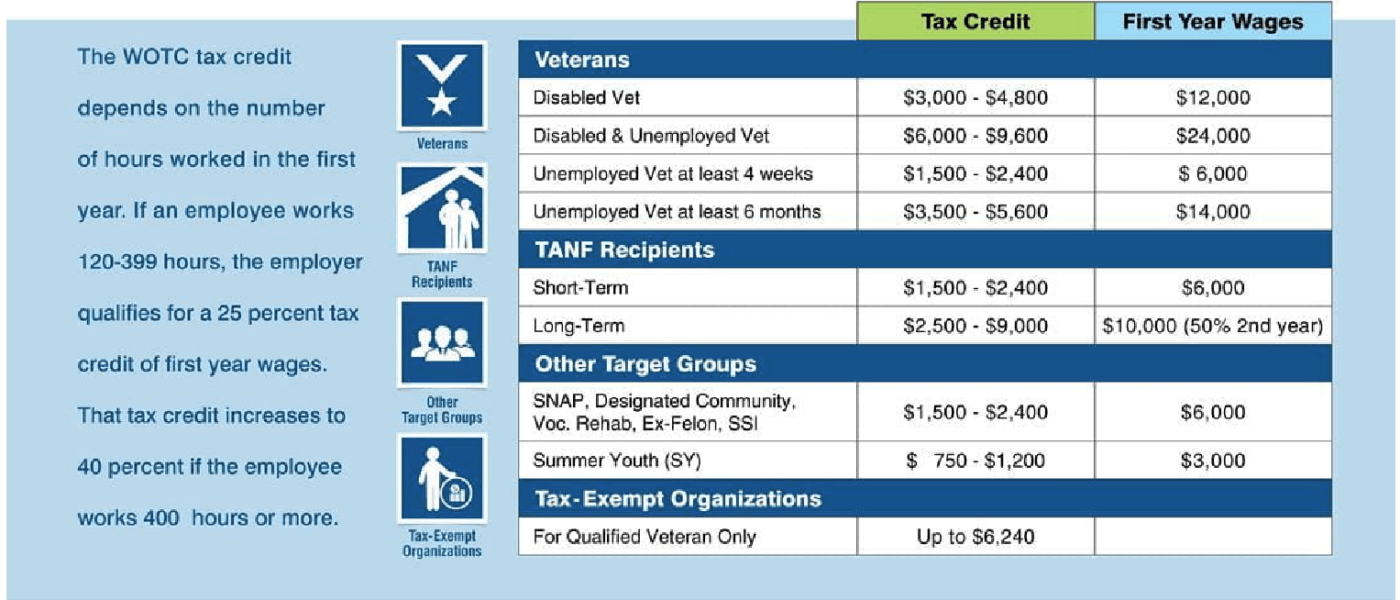

The Federal Work Opportunity Tax Credit, or WOTC, is a general business credit provided under section 51 of the Internal Revenue Code (Code) that is jointly administered by the Internal Revenue Service (IRS) and the Department of Labor (DOL). The WOTC is available for wages paid to certain individuals who begin work on or before December 31, 2025. The WOTC may be claimed by any employer that hires and pays or incurs wages to certain individuals who are certified by a designated local agency (sometimes referred to as a state workforce agency) as being a member of one of 10 targeted groups. In general, the WOTC is equal to 40% of up to $6,000.00 of wages paid to, or incurred on behalf of, an individual who:

- is in their first year of employment;

- is certified as being a member of a targeted group; and

- performs at least 400 hours of services for that employer.

The maximum tax credit is generally $2,400.00. A 25% rate applies to wages for individuals who perform fewer than 400 but at least 120 hours of service for the employer. Up to $24,000.00 in wages may be taken into account when determining the WOTC for certain qualified veterans. An employer cannot claim the WOTC for employees who are rehired or the employer’s family members.

Key Target Groups

An employer may claim the WOTC for an individual who is certified as a member of any of the following targeted groups under section 51 of the Code:

The formerly incarcerated or those previously convicted of a felony

Recipients of state assistance under part A of title IV of the Social Security Act (SSA)

Veterans

Residents in areas designated as empowerment zones or rural renewal counties

Individuals referred to an employer following completion of a rehabilitation plan or program

Individuals whose families are recipients of supplemental nutrition assistance under the Food and Nutrition Act of 2008

Recipients of supplemental security income benefits under title XVI of the SSA

Individuals whose families are recipients of state assistance under part A of title IV of the SSA

Individuals experiencing long-term unemployment

Key Industries:

While the WOTC is broadly applicable to businesses, there are certain types of industries that the tax credit is more advantageous for based on the organization’s workforce. Here are the top business types for the Work Opportunity Tax Credit:

Quick Serve Restaurants

Multi-Unit /Multi-Location Companies

Large Employers

High Turnover Organizations

Employers who employ Veterans

Manufacturers

Seasonal Employers

These industries are ideal for claiming WOTC because they have high wages, high turnover or a seasonal business model. They also have positions that have the greatest number of Certifications by occupation such as business & financial operations, office & administrative support and production employees. We recommend that every business pursues WOTC. Our app, Taxploration, enables the easy capture of new hire information with minimal involvement from the employer and there are no upfront costs. By leveraging Taxploration, businesses can effortlessly access WOTC benefits, maximizing their tax credit potential while minimizing administrative burdens.

New Hire Eligibility Process

New Hires complete a questionnaire that helps determine eligibility for the WOTC. Each pre-qualified new hire will need to submit the required supporting documentation depending on the target group to verify identity. Pre-qualified new hires are submitted to a State Workforce Agency (SWA) determined by the state where the employer is physically located. The submission must be made within 28 calendar dates from the new hire’s start date.

The McMillian Advantage

We believe that business activities create tax credit opportunities. Our purpose it to help business create new opportunities. We start by understanding your business and your onboarding process. Knowing what you do, what positions you have and how you onboard your new hires enables McMillian to maximize your tax credit opportunity. We use proprietary, independent technology to manage tax credit activities. We offer three options to complete the New Hire Questionnaire so that you can use the option that works best with your onboarding process: a paper form that is mailed to McMillian, digitally via our proprietary app Taxploration or mobile via a custom QR Code.

Paper

Digital

Mobile

Taxploration is an independent app that is part of your onboarding process. If one of your onboarding processes changes, you don’t need to change who your WOTC provider is. Pairing technology with human oversight, we minimize your workload while maximizing your tax credit potential. Selecting McMillian to manage the Work Opportunity Tax Credit for your company mitigates risk and less than maximum tax credit opportunities. We do the following things that every WOTC provider should do that not all do:

- Compliance: we work with your entire organization to ensure that every person hired is screened for WOTC eligibility

- Training: we train your team on WOTC best practices to maximize compliance and tax credit amount

- Confirm New Hire Information: we validate new hire information that may be incorrect or request missing information. This includes entity or location they work for, start date, address, etc.

- Documentation: We request required documents at the time of hire so that we have them when the state requests them. Even if an employee is no longer employed when the state asks for their documents, if we have them at the time they are hired then we can submit them to the state upon their request.

- Determinations: we monitor your determination status with the SWAs so that we can provide requested information in a timely manner or appeal a Denial notice.

Our target is zero missed opportunities, and we provide on-going reporting and tracking to reach this target. Selecting McMillian to manage the Work Opportunity Tax Credit for your company mitigates risk and less than maximum tax credit outcomes.

Claiming the Work Opportunity Tax Credit

Employers may claim the Federal Work Opportunity Tax Credit for certified new hires based on the target group, first year wages earned, and first year hours worked. The Work Opportunity Tax Credit is reported on IRS Form 5884. Taxpayers may claim the tax credit for certified new hires in the year in which the certification was received. In general, taxable employers may carry the current year’s unused WOTC back one year and then forward 20 years. See the Instructions to Form 3800 (General Business Credit) for more information.

Before we prepare your WOTC tax forms, we review other Federal tax credits that you may be receiving to ensure that all requirements for each tax credit have been met and that there is no overlapping of the wages used for multiple credits. We maintain all documentation, such as payroll, WOTC Certifications, and Employee summaries that is required for the tax credit for the time period required by the IRS.

Resources For Connecting with Job Seekers

1. The American Job Centers (https://www.dol.gov/general/topic/training/onestop) helps employers connect with skilled job seekers who may be members of WOTC targeted groups.

2. State Department of Labors have resources to assist with connecting with individuals who are seeking employment who may be members of WOTC targeted groups

3. Participating agencies are federal, state, county or local government agencies who work with state Workforce Agencies (SWA) to connect employers with job seekers. Examples of eligible agencies are Vocational Rehabilitation agencies, city and county social service offices, state or local department of correction and Veterans Administration and related service organization.

Resources for National WOTC Results

1. The National WOTC Performance results are available here: https://www.dol.gov/agencies/eta/wotc/performance

2. The Employment and Training Administration WOTC Fact Sheet is here: https://www.dol.gov/sites/dolgov/files/ETA/wotc/pdfs/WOTC-Fact-Sheet-2024.pdf

Connect With Us

To learn more about how McMillian & Associates can help you get started with the Work Opportunity Tax Credit connect with us.